With global fines against non-compliant entities skyrocketing by a staggering 50% each year, understanding the gravity of AML violations is more critical than ever. In this comprehensive article, we delve into the world of AML fines, dissecting recent cases from 2023 to shed light on the repercussions of alleged money laundering infractions.

From hefty penalties to regulatory scrutiny, we explore the harsh realities that companies face for AML non-compliance. Additionally, we provide actionable strategies to help firms fortify their compliance measures and steer clear of costly fines.

Join us as we navigate the intricacies of AML enforcement and empower businesses with the knowledge and tools they need to safeguard against financial risk.

Why are AML fines imposed and how are they determined?

An AML fine, short for Anti-Money Laundering fine, represents a monetary sanction levied against individuals or entities failing to adhere to AML regulations. These fines can vary widely in size, contingent upon the severity and scope of the non-compliance.

The imposition of AML fines serves a dual purpose: to penalize and deter non-compliant behavior while also sending a clear message to financial institutions about the seriousness of adhering to AML obligations. Such penalties can stem from various violations, including inadequate customer due diligence procedures or insufficient systems and controls to monitor customer activity effectively.

So, how exactly are AML fines determined?

AML fines are typically administered by regulatory bodies such as the Financial Conduct Authority (FCA). When evaluating a case, the FCA considers several key factors to ascertain the appropriate level of financial penalty. These factors encompass:

- The volume of laundered funds: The larger the sum of money involved in the laundering activities, the higher the potential fine.

- Duration of the offense: The length of time over which the non-compliance occurred plays a significant role in determining the severity of the fine.

- Extent of non-compliance: The degree to which the entity failed to adhere to AML regulations is carefully scrutinized and influences the magnitude of the fine.

- Related offenses: Any additional infractions related to AML regulations may further compound the penalties imposed.

- Past conduct of the financial institution: The regulatory history and prior compliance record of the entity under investigation are taken into account.

Once these factors have been thoroughly assessed, the regulatory authority determines the appropriate AML fine commensurate with the level of non-compliance exhibited.

Cumulative AML penalties, actions and events In 2023

In 2023, the landscape of Anti-Money Laundering (AML) enforcement witnessed a flurry of regulatory activity, with a staggering 2,940 events involving actions taken by regulating agencies or equivalents against entities for AML, money laundering, or related infractions.

This data, sourced from the Top 10 Anti-Money Laundering Penalties 2023 Global Report by Zigram, a leading Data Asset company specializing in RegTech solutions, offers a comprehensive insight into the global AML enforcement landscape.

Cumulatively, these events resulted in a hefty $44 billion in monetary penalties, including fines, monetary penalties, forfeitures, and more, levied against offending entities. This substantial financial impact underscores the severity with which regulatory bodies address AML violations.

Within this regulatory crackdown, a total of 1,450 organizations faced fines or penalties from regulatory agencies for their involvement in AML events. This indicates the widespread nature of AML non-compliance across various sectors and industries.

Furthermore, the report highlights the individual repercussions of AML actions, with 5,120 individuals facing fines, penalties, or incarceration by regulatory agencies due to their involvement in AML-related activities. This underscores the accountability placed on both organizations and individuals in adhering to AML regulations.

The gravity of AML violations is further emphasized by the significant number of imprisonments, totaling 752,000 months served by individuals incarcerated or confined in institutional settings as a result of AML events.

Yes: the data presented in this report paints a vivid picture of the widespread regulatory action and significant financial and personal consequences stemming from AML violations in the year 2023.

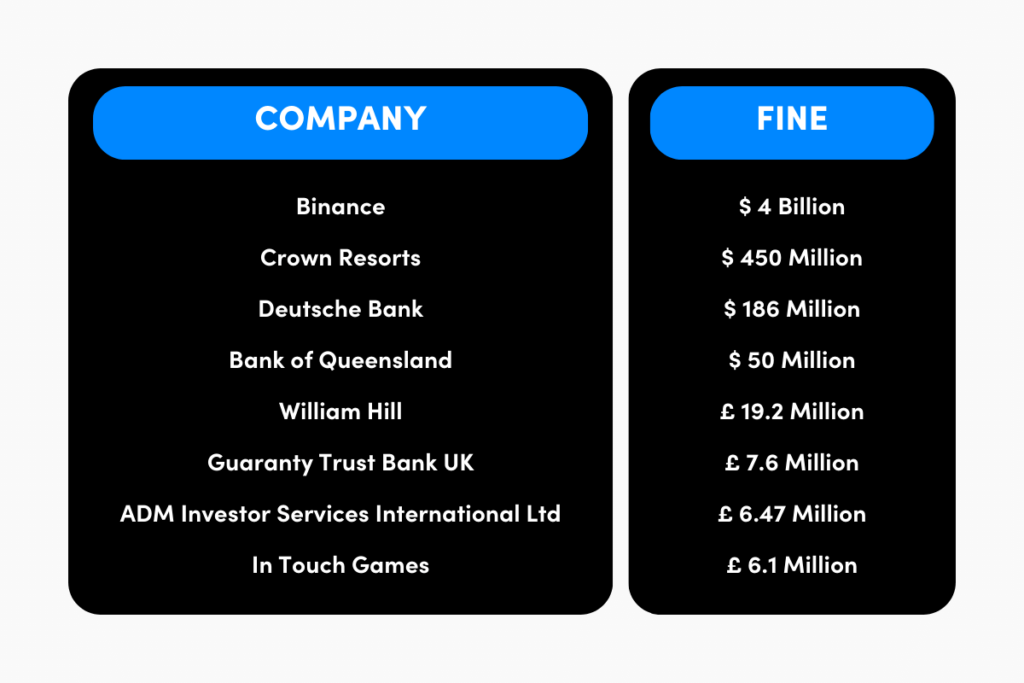

The biggest AML fines of 2023

In 2023, several significant fines were imposed on entities across various sectors for violations of Anti-Money Laundering (AML) regulations. Here are some of the most notable AML fines of the year:

Binance:

- Binance, one of the world’s largest cryptocurrency exchanges, faced a landmark fine of $2.7 billion imposed by a U.S. court. The fine was the result of a case brought by the U.S. Commodity Futures Trading Commission (CFTC), alleging numerous AML violations.

- Among the infractions cited were Binance’s failure to report suspicious transactions, violations of anti-money laundering and sanctions laws, and associations with entities involved in terrorism and child exploitation.

- Former CEO Changpeng Zhao also faced a separate fine of $150 million as part of the court’s ruling.

Crown Resorts:

- Crown Resorts, a prominent Australian casino operator, incurred a significant fine of $450 million imposed by the Australian Transaction Reports and Analysis Centre (AUSTRAC).

- The fine stemmed from past violations of Australian anti-money laundering legislation at Crown’s casinos in Perth and Melbourne.

- AUSTRAC highlighted Crown’s failure to adequately address money laundering and terrorist financing risks, emphasizing the importance of stringent AML controls within the gambling industry.

William Hill:

- William Hill, a renowned British bookmaker, faced a record-high fine of £19.2 million for AML compliance failures, along with its sister brand, Mr. Green.

- The fines were levied by regulatory authorities for the operators’ failure to implement effective AML controls, allowing significant sums to be spent without proper due diligence checks.

- One notable instance involved a customer opening an account and spending £23,000 in just 20 minutes without adequate scrutiny.

Guaranty Trust Bank UK Ltd:

- Guaranty Trust Bank UK Ltd received a fine of £7.6 million for major deficiencies in its AML processes and controls, as determined by regulatory authorities.

- Among the identified shortcomings were failures to conduct due diligence on high-risk clients and investigate the origin of clients’ wealth or assets.

Bank of Queensland:

- The Bank of Queensland (BOQ) faced a penalty of $50 million for breaching financial standards and failing to comply with anti-money laundering laws.

- Regulatory authorities cited BOQ for its failure to implement adequate AML controls, necessitating a significant capital penalty until remedial action is taken.

Al Rayan Bank:

- Al Rayan Bank, the largest Islamic bank in the United Kingdom, was fined £4 million by the Financial Conduct Authority (FCA) for neglecting to conduct adequate checks on high-risk customers and deficiencies in AML training and procedures.

- Regulatory authorities highlighted Al Rayan Bank’s failure to maintain up-to-date due diligence records and implement adequate procedures for handling significant cash deposits.

In Touch Games:

- In Touch Games, an online gambling operator operating multiple gaming platforms in the UK, faced a substantial fine of £6.1 million from the UK Gambling Commission for AML and social responsibility failures.

Which countries have the most AML fines?

When it comes to severe Anti-Money Laundering (AML) fines, several countries stand out prominently:

- United States: Known for its stringent enforcement of AML regulations, the United States has imposed hefty fines on entities found guilty of money laundering violations.

- United Kingdom: The UK has also seen significant AML fines, reflecting the country’s commitment to combating financial crime and maintaining the integrity of its financial system.

- Switzerland: With its prominent banking sector, Switzerland has faced scrutiny and substantial fines for AML deficiencies, highlighting the global impact of money laundering regulations.

- Singapore: As a global financial hub, Singapore has implemented robust AML measures but has also faced notable fines for non-compliance, signaling the importance of vigilance in maintaining financial integrity.

- Hong Kong: Similarly, Hong Kong’s status as a major financial center has brought attention to AML enforcement, resulting in significant penalties for entities found in violation of AML regulations.

Money laundering remains a serious crime with far-reaching consequences for global financial systems. Governments and regulatory bodies worldwide are intensifying efforts to combat this threat through stringent AML laws and regulations. As evidenced by the substantial fines imposed on countries like the United States, United Kingdom, Switzerland, Singapore, and Hong Kong, authorities are leaving no stone unturned in holding offenders accountable and safeguarding the integrity of the financial sector.

How to avoid AML fines?

To effectively avoid AML fines and ensure compliance with regulations, businesses need to implement robust processes and tools. Businesses can take specific steps to strengthen their AML compliance:

- Appointing a Money Laundering Reporting Officer (MLRO) responsible for overseeing AML efforts.

- Providing timely and comprehensive staff training on AML regulations and procedures.

- Identifying and assessing corporate risks associated with money laundering.

- Utilizing transaction monitoring tools to detect suspicious activities.

- Maintaining thorough records of client interactions and transactions.

- Promptly reporting any suspicious activity to regulatory authorities.

- Implementing robust client identity verification methods and customer due diligence processes.

Implementing an automated KYB process, such as Silt, can greatly enhance AML compliance efforts. Silt streamlines the KYB process, saving valuable time, reducing the risk of fraud, and ensuring regulatory compliance.

By automating data collection and verification, Silt enables businesses to handle a higher volume of KYB checks efficiently and scale their operations effectively.

Silt also simplifies analysis by providing a centralized dashboard for managing all KYB verifications, including relevant information and official documents. This comprehensive approach enables businesses to maintain compliance effectively while minimizing manual effort and streamlining operations.

Don’t wait any longer to enhance your AML compliance efforts. Consider the benefits of KYB automation with Silt to drive success and security for your business. Take advantage of our free demo to see how Silt can transform your AML processes today.

There are no comments

Leave a comment